The event was empowering! It’s motivated me to look deeper into my finances and to be comfortable to kōrero about money, investing, side hustles. It’s been an eye opener and I look forward to more money kōrero in the future!

He Matapaki Māreikura is a place for Whai Rawa wāhine members to come and kōrero about life, pūtea and whānau.

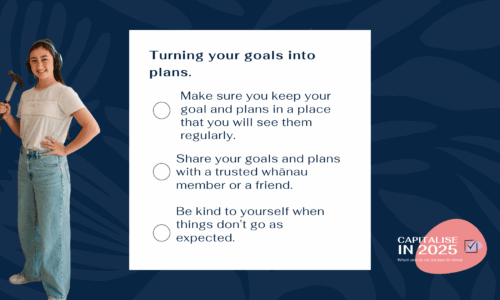

We want you to feel confident and take control of your finances – and your future! We will share ideas about how you can think ahead, give you advice from the experts, top tips from us, and ways to make it all happen.

There’s so much to love, but my ultimate favourite is the amazing support. Always so welcoming, quick and easy – like asking a good friend to help you out!

Julie - Te Whanganui-a-Tara

I found the session really really helpful – and motivational for that next step in addressing finances – I have been so avoidant was the prompt I needed. I even managed some immediate actions – I checked on my Kiwisaver today and confirmed my fund choice.

Deirdre - Ōtautahi

Thinking ahead

Top tips

Advice from the experts

Making it happen

Capitalise in 2025

Whati ana te tai, ka pao te tōrea

The third month of capitalise is here! We’ve collated a number of tips, actionable steps and information. Our third month is focused on saving and investing!

Take our poll to help us understand where you are at.

PĀNUI INAMATA

Our latest articles

The information contained on this page is intended for general guidance and information only and is not personalised to you. It does not take into account your particular financial situation or goals.

The links shared and associated content hosted on our websites or hosted on any third-party provider websites have not been vetted or otherwise approved by Whai Rawa Fund Limited and neither Whai Rawa Fund Limited, nor Te Rūnanga o Ngāi Tahu endorse the linked material or its provider in any way. The information provided by these links and third-party providers is not personalised to you and your situation. Before making any investment decision, you should refer to the Product Disclosure Statement and / or consult a licenced financial advice provider.

Whai Rawa Fund Limited is the issuer of the Whai Rawa Unit Trust. A copy of the Product Disclosure Statement is available at www.whairawa.com/pds. All content is subject to WRFL’s financial advice disclosure statement available here www.whairawa.com/financial-advice.