BUILDING AN EMERGENCY FUND – HOW TO DO IT AND WHY.

Are you prepared for the unexpected? Having an emergency fund is a good place to start if you’re looking to help build a sense of financial security. Setting up an account with a buffer can help you remain on top of your expenses or avoid debt if an unexpected expense does come up.

How much do I need to save?

The amount of an emergency fund may vary from person to person and can depend on many factors such as:

- your current expenses

- if you’ve got a pet, tamariki or other whānau to support

- if you’re likely to incur any costs in the future – think dentist appointments, potential car or house repairs etc

![]()

TOP TIPS FROM THE TEAM:

SET UP AN ACCOUNT YOU CAN’T TOUCH –Making an account at another bank to your main bank or utilising an account that has fees to withdraw money from will make it more of an incentive for you not to touch it and to keep building your pūtea!

MAKE IT AUTOMATIC – When you get paid set up an automatic payment to your savings account so it is done and you’re not tempted to find other things to do with the money. Pay yourself first and make it automatic so your habit forms.

IF YOU NEED TO USE IT, DO! – Once you’ve set up your budget and your goals, it’s a good idea to make saving automatic. Set up an automatic payment so that you don’t even have to think about it, and you’re less tempted to start spending it.

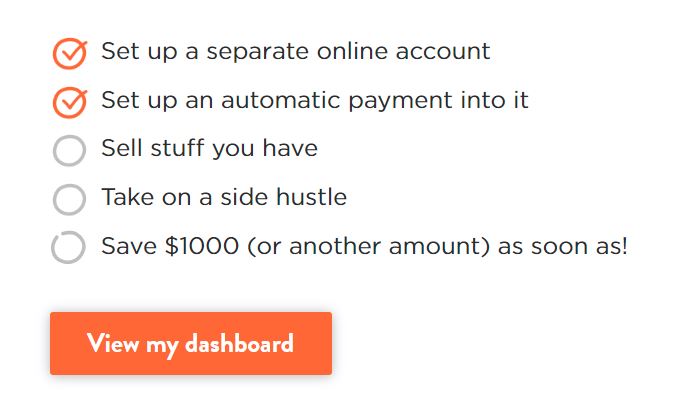

MAKE IT HAPPEN – Our friends at Live Sorted NZ have a checklist you can use to track your progress! All you need to do is create an account with Live Sorted NZ and add a task or goal to your checklist. You can regularly update this with your progress to stay motivated and keep on track.

Find more information here https://sorted.org.nz/6-steps-to-get-your-money-sorted/start-your-emergency-fund/

The information contained on this page is intended for general guidance and information only and is not personalised to you. It does not take into account your particular financial situation or goals.

The links shared and associated content hosted on our websites or hosted on any third-party provider websites have not been vetted or otherwise approved by Whai Rawa Fund Limited and neither Whai Rawa Fund Limited, nor Te Rūnanga o Ngāi Tahu endorse the linked material or its provider in any way. The information provided by these links and third-party providers is not personalised to you and your situation. Before making any investment decision, you should refer to the Product Disclosure Statement and / or consult a licenced financial advice provider.

Whai Rawa Fund Limited is the issuer of the Whai Rawa Unit Trust. A copy of the Product Disclosure Statement is available at www.whairawa.com/pds. All content is subject to WRFL’s financial advice disclosure statement available here www.whairawa.com/financial-advice.