STARTING A NEW JOB – OUR BEST TIPS AND TRICKS!

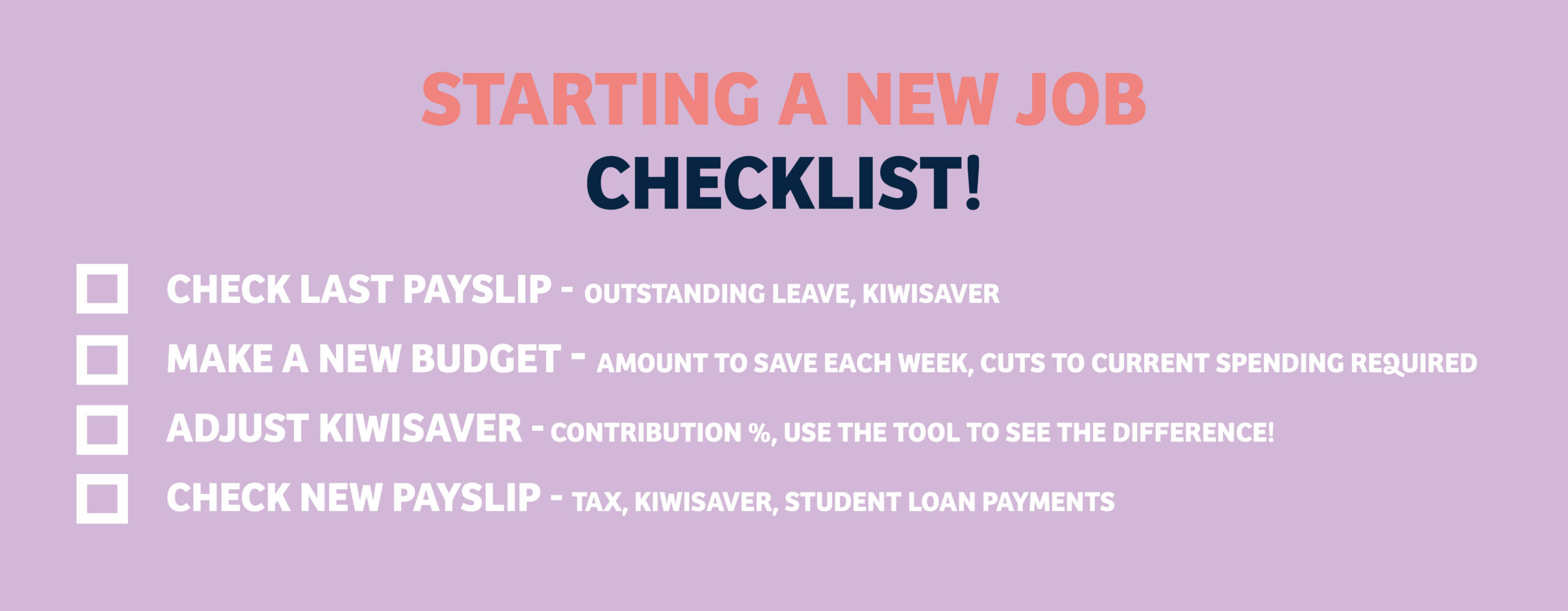

Congratulations if you have recently started or are starting a new role! Starting a new job can be an exciting time, and a great opportunity to reassess your financial situation and goals. We have compiled a check list to help you with the financial side to your new mahi so you can get all the benefits.

1. Check you’ve been paid out correctly from your last role

Look at your last payslip and check that you have been paid out any outstanding leave. Consider what to do with your holiday pay – can you afford to invest it or will you use it to pay off any debt you might have? It can be a substantial chunk of money so think about what it is best to do with the pay.

2. Re-assess your budget based on your new income

What to do if you’re getting a pay rise:

- It will be exciting to have more in your account in each week! However, if you were comfortably living on your previous wage, you may not need to keep this in your everyday account.

- Make a plan for this additional amount, otherwise it can turn into ‘lifestyle creep’.

- Can you put the difference each week into a savings account and/or your Whai Rawa account?

If you’re taking a pay cut:

- This can be a good opportunity to review your current spending and look at what can you cut out/minimise to offset this pay cut e.g., subscriptions.

- It may be a good time to shop around for your power/Wi-Fi to see if there are better deals out there.

- Saving will still be important but perhaps you adjust the amount you save.

3. KiwiSaver

- KiwiSaver can be an important way to help you to get ahead long-term.

- Your employer must offer you the opt in KiwiSaver form. If you opt in, they are legally required to contribute 3% of your gross salary or wage (some may contribute more).

- You have the choice to contribute 3%, 4%, 6%, 8% or 10% of your gross salary or wage. Even a 1% difference can have a significant impact on your future amount. Use the Sorted calculator to experiment what you could have KiwiSaver calculator » Sorted

4. Check your payslip!

When your first payslip comes through, make sure to check that the amounts are all correct and query anything you are not sure about.

- Check your tax, KiwiSaver, and student loan payments.

The information contained in this document is intended for general guidance and information only and is not personalised to you. It does not take into account your particular financial situation or goals.

The links shared and associated content on this website have not been vetted or otherwise approved by Whai Rawa Fund Limited and neither Whai Rawa Fund Limited, nor Te Rūnanga o Ngāi Tahu endorse the linked material or its provider in any way. The information provided by these links and third-party providers is not personalised to you and your situation. Before making any investment decision, or taking any action or not, you should refer to the Product Disclosure Statement and / or consult a licensed financial advice provider.

Whai Rawa Fund Limited is the issuer of the Whai Rawa Unit Trust. A copy of the Product Disclosure Statement is available at www.whairawa.com/pds. A financial advice disclosure statement is available for Whai Rawa Fund Limited at www.whairawa.com/financial-advice.