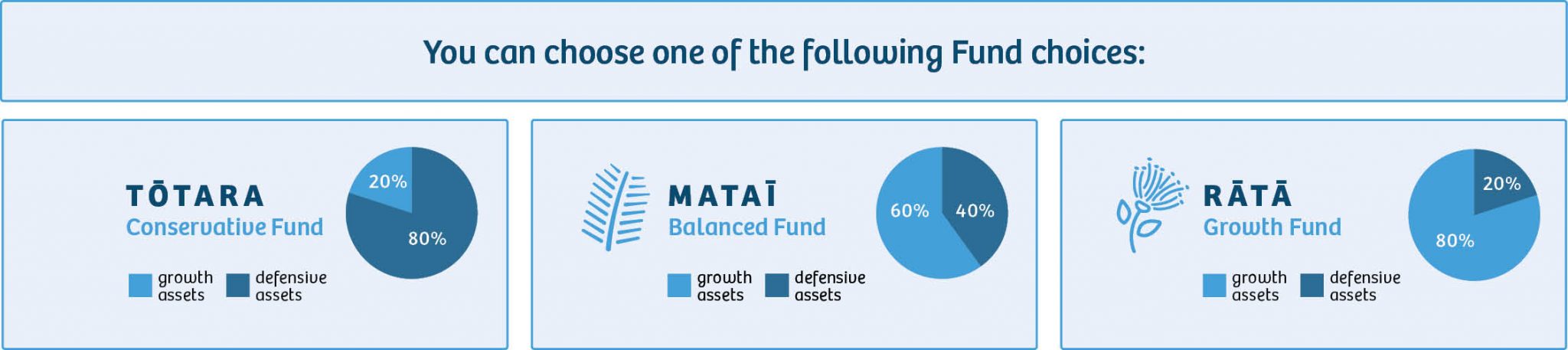

Choose from Tōtara-Conservative Fund

This Fund invests mostly in cash and fixed interest assets, with only some investment in shares and real assets. It seeks to provide growth of your investment through consistent returns using a diversified portfolio that has a bias towards defensive assets. This option may be suitable for investors who want to achieve slightly higher returns than those expected from investing solely in bank deposits, fixed interest investments or cash. Investors need to be comfortable with the possibility of some fluctuations in the value of their savings.

Minimum suggested investment timeframe: 3 years

Choose from Mataī-Balanced Fund

This Fund invests in a wide range of assets and seeks to provide long-term capital growth for your savings by using a diversified portfolio with a slight bias towards growth assets. This option may be suitable for investors who want a diversified investment with exposure to shares and real assets, who are comfortable with greater fluctuations in the value of their savings than can be expected from the Tōtara-Conservative Fund and who want to invest for the long term.

Minimum suggested investment timeframe: 8 years

Choose from Rātā-Growth Fund

This Fund also uses a diversified portfolio but invests mainly in shares and property related assets. It seeks to provide higher long-term capital growth for your savings from its stronger exposure to growth assets and lower investment in defensive assets. This option may be suitable for investors wanting to invest mostly in growth assets and who are comfortable accepting more fluctuations in the value of their savings than those expected from the Mataī-Balanced Fund with a view to achieving higher longer-term returns.

Minimum suggested investment timeframe: 10 years

How do I switch Funds?

Log in to your account to access the options.

Inside the website you can take the Risk Quiz, make a Fund choice or just look at the options. You can also choose to remain in the Tōtara-Conservative Fund.