Risk Appetite Statement

This document considers the most significant risks to which Whai Rawa Fund Limited (WRFL) is exposed. The majority of WRFL’s business activities and member services are conducted through third-party service providers. WRFL’s use of third-party service providers and resulting institutional relationships together with its regulatory environment and shareholder/ parent company

relationship, influence the nature of the risks WRFL is exposed to and how it manages and seeks to mitigate these risks.

Section 1: Overview

1.1 Overview

This document considers the most significant risks to which Whai Rawa Fund Limited (WRFL) is exposed. The majority of WRFL’s business activities and member services are conducted through third-party service providers. WRFL’s use of third-party service providers and resulting institutional relationships together with its regulatory environment and shareholder/ parent company relationship, influence the nature of the risks WRFL is exposed to and how it manages and seeks to mitigate these risks.

1.2 WRFL Operating Environment – General Statements of Appetite

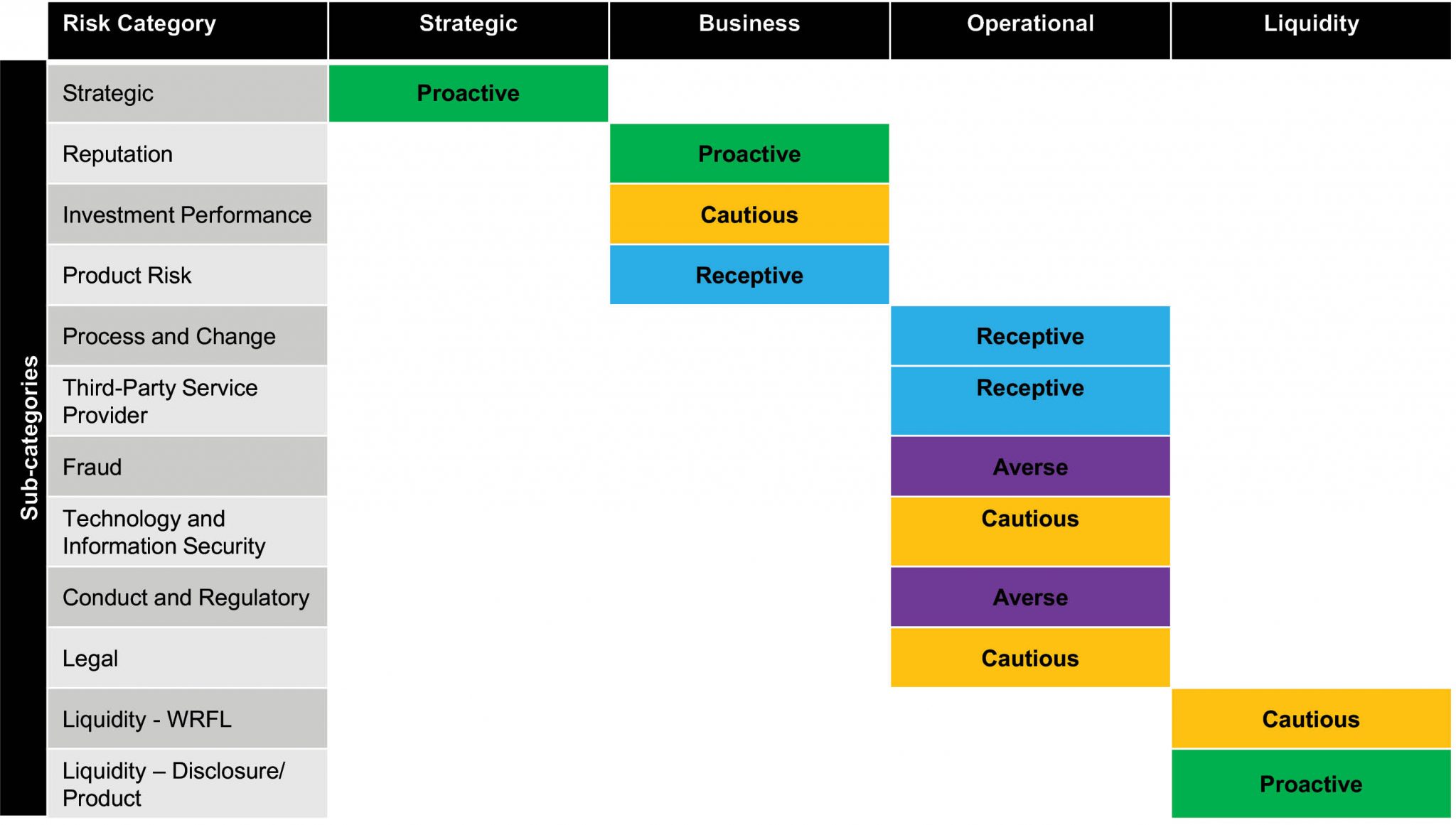

WRFL is exposed to a variety of risks as a result of its business activities. These risks result from it being the manager of a Trust* and its responsibilities in the areas of setting of objectives for the investments of the Trust’s assets, appointing fund manager(s) and monitoring their performance, monitoring of investment results, compliance with legislative and regulatory requirements and day to day operational activities. These activities are conducted within the boundaries of WRFL’s accountability to its shareholder and to its members.

WRFL has a low tolerance for risks that will adversely affect it business. WRFL employs Te Rūnanga o Ngāi Tahu’s risk management policy and framework to actively monitor the potential impact of current and emerging risks. WRFL relies on the integrity and conduct of its kaimahi underpinned by a strong ethical culture.

WRFL accepts that its investments are exposed to market forces including credit and liquidity impacts. Selection of fund managers and monitoring their performance against investment parameters and objectives is used to minimise the impacts of market forces.

Operationally WRFL accepts that it is neither possible nor necessarily desirable to eliminate risks inherent in its activities – acceptance of some residual risks is necessary to achieve efficiencies within the business.

*The Trust was established by Te Rūnanga o Ngāi Tahu (“TRoNT”) in 2006 to build the wealth of Ngāi Tahu Whānui members by encouraging savings and facilitating receipt of distributions from TRoNT.

Section 2: Summary of Risk Appetite by Risk Category

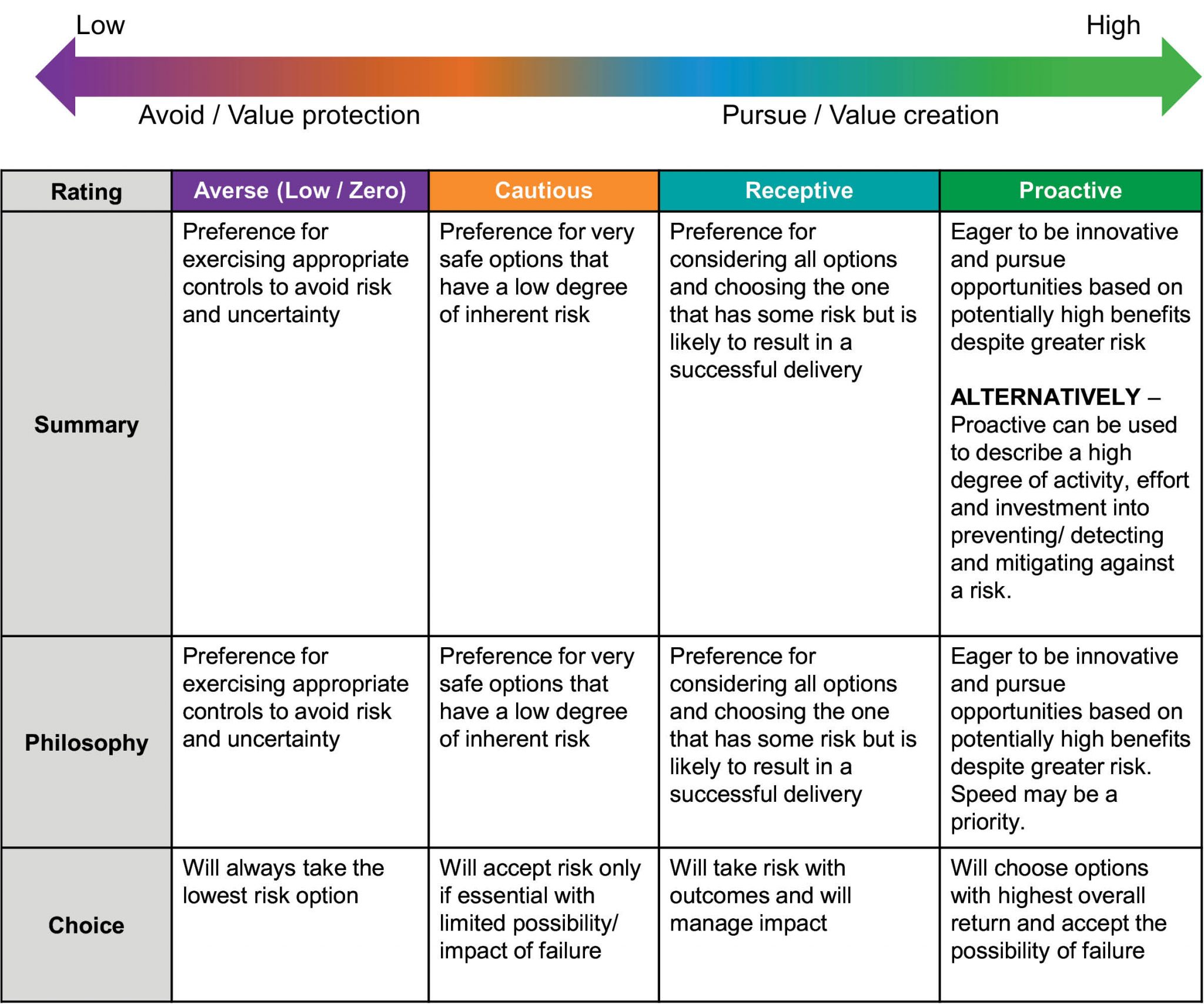

Risk Appetite Categories and Descriptors