Whakarāpopototaka mākete / Market Commentary

Market Summary

This market update for Whai Rawa is for the three months to 30 September 2025. September saw a mostly positive market environment emerge as hopes remain high for progress to be achieved in trade negotiations between China and the USA. The US Federal Reserve cut interest rates by 25 basis points, while other major central banks largely held steady.

Geopolitical risk remains elevated in the Middle East and Russia particularly with fighting still continuing despite the ceasefire deal in the West Bank and NATO air defences responding to Russian drone and fighter jet incursions.

Equity markets advanced globally, with developed markets buoyed by strong gains in the technology sector. The MSCI world index (unhedged) saw a 4.9% rise driven by robust earnings from major US tech companies.

New Zealand equities posted a solid 3.0% gain, driven primarily by strength in the materials sector. The Official Cash Rate (OCR) was lowered to 2.5% in October this year. Despite this, inflation pressure remain and the RBNZ is expected to cut interest rates into 2026. GDP data was weaker than expected and unemployment remains high. New Zealand listed property soared up 5.8% as investors sought income and inflation protection.

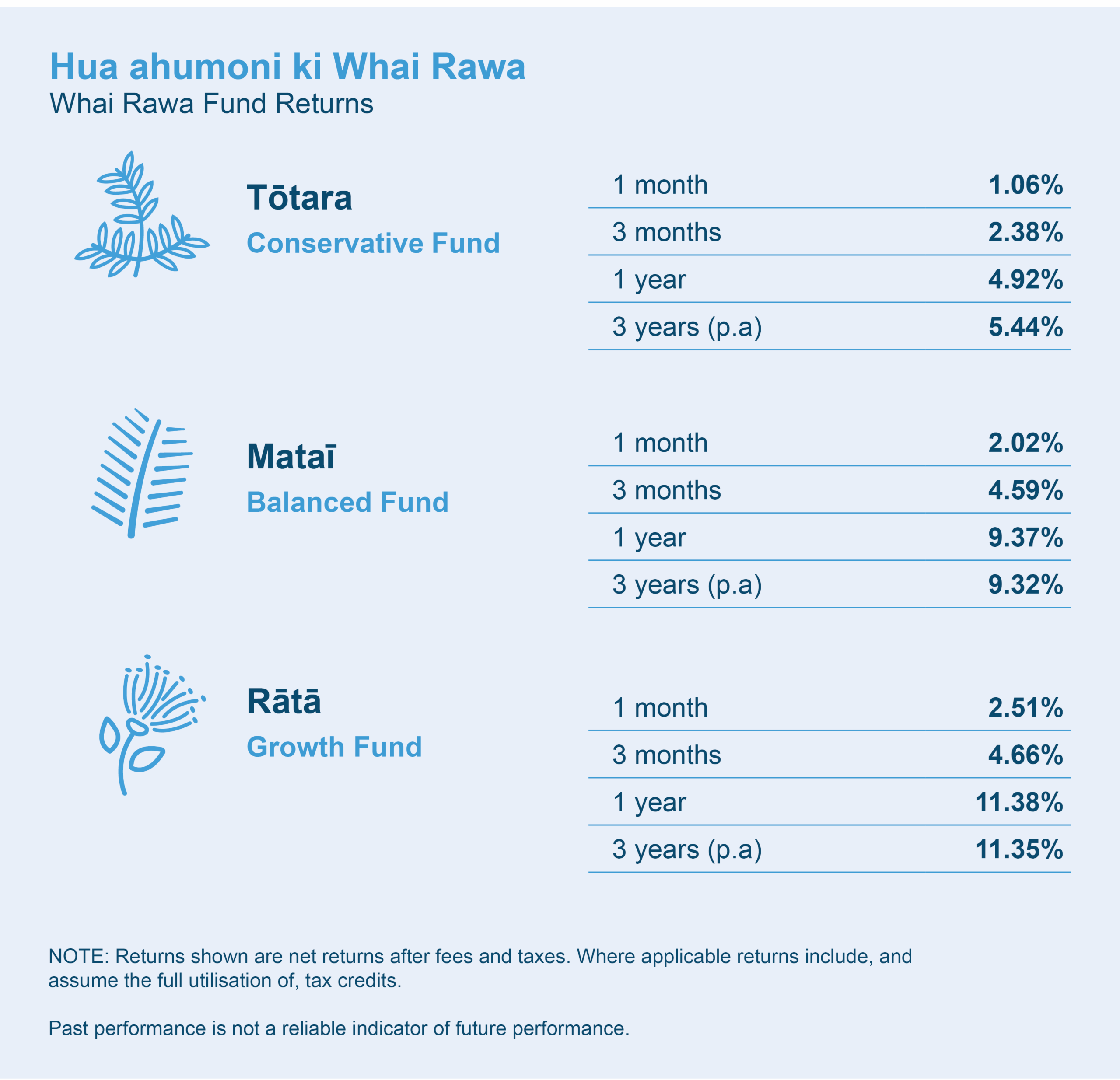

All three Whai Rawa funds were positive in the month of September and for the quarter to 30 September 2025.

For the quarter our Tōtara-Conservative Fund returned 2.38%, our Mataī-Balanced Fund returned 4.59% and the Rātā-Growth Fund returned 5.67%.

These returns are after fees and taxes (at a 28% prescribed investor rate or PIR).

How does this affect my Whai Rawa account?

Depending on what fund you’re invested in, the return for your Whai Rawa account can be affected, positively or negatively. It’s important that with any investment you are prepared for ups and downs in your balance and that the fund you choose fits with your risk profile (how much risk you’re willing to tolerate) and timeframe for investing.

How do I know if I’m in the right fund for me?

Take our 5-question risk quiz on our website to ensure your fund choice and risk profile match. Head to www.whairawa.com/riskquiz.