Whakarāpopototaka mākete / Market Commentary

Market Summary

This market update is for the three months to 31 December 2025. December 2025 saw mildly positive equity performance amid a backdrop of significant geopolitical and economic developments. This was notably supported by the US Federal Reserve’s decision to cut interest rates, though the Fed signalled the possibility of fewer rate cuts going forward as inflation remains sticky.

On the economic front, New Zealand’s Quarter 3 GDP growth exceeded expectations, and business confidence surged to a 30-year high, signalling a robust economic recovery. Central banks globally largely acted in line with market expectations, with the Bank of England and the US Federal Reserve both lowering interest rates, while the Bank of Japan raised rates slightly.

Global equities experienced a steady advance in December, with international shares rising 0.5% (MSCI World Index (hedged)), contributing to an 18.4% gain over 2025. The financials and materials sectors led the gains, rising 4.1% and 3.2% respectively. The materials sector was boosted by continued strength in metal prices. Conversely, the utilities sector lagged, declining -3.3% during the month.

The market was led by strong performances in the industrial, health care, and communication sectors, while the technology sector showed mixed results. Dividend-focused and rate-sensitive companies faced headwinds due to an increase in longer-term interest rates, which tempered gains in some areas of the market.

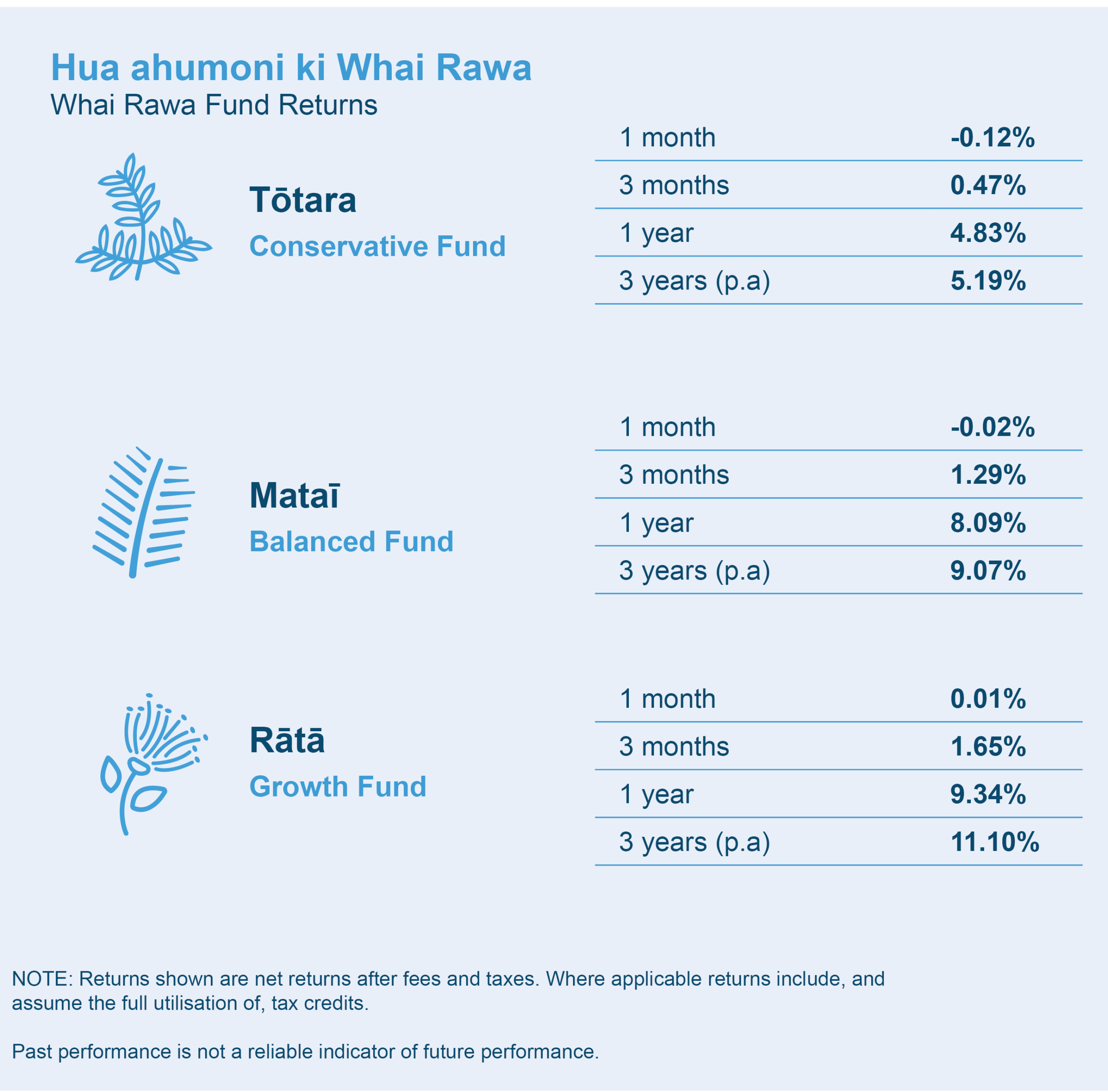

All three Whai Rawa funds were positive for the quarter to 31 December 2025.

For the quarter our Tōtara-Conservative Fund returned 0.47%, our Mataī-Balanced Fund returned 1.29% and the Rātā-Growth Fund returned 1.65%.

These returns are after fees and taxes (at a 28% prescribed investor rate or PIR).

How does this affect my Whai Rawa account?

Depending on what fund you’re invested in, the return for your Whai Rawa account can be affected, positively or negatively. It’s important that with any investment you are prepared for ups and downs in your balance and that the fund you choose fits with your risk profile (how much risk you’re willing to tolerate) and timeframe for investing.

How do I know if I’m in the right fund for me?

Take our 5-question risk quiz on our website to ensure your fund choice and risk profile match. Head to www.whairawa.com/riskquiz.