Overview

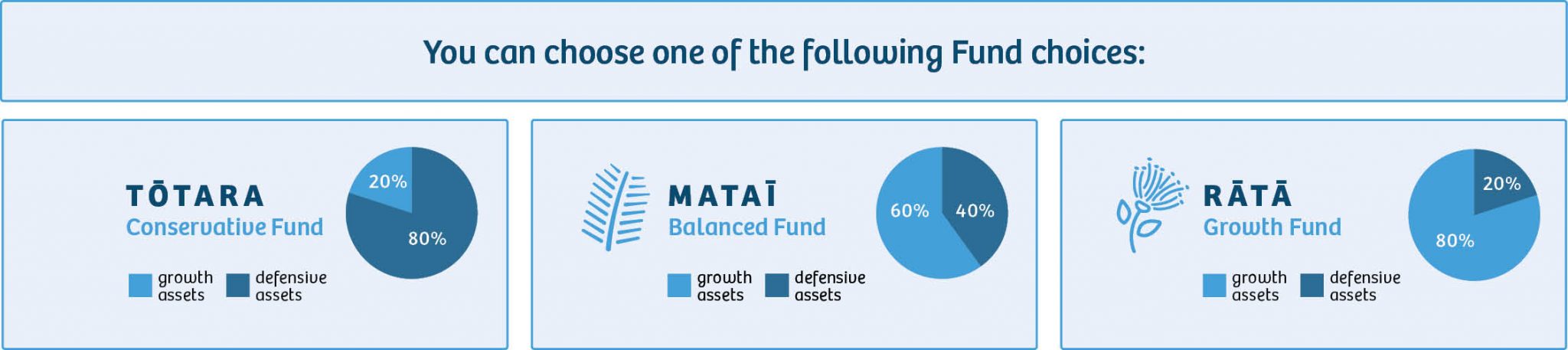

Member’s Whai Rawa funds are able to be invested in the Mercer Investment Trusts New Zealand’s Socially Responsible Conservative, Balanced and Growth Portfolios.

Each portfolio has a different level of risk and accordingly different return expectations.

Current Whai Rawa Investment

Three funds were introduced to ensure that all our whānau have options as to which Whai Rawa investment fund their money is invested in. Looking at the options available ensures that at any age or life stage you can choose a Fund that better reflects the personal needs and risk appetite of your whānau.

The Whai Rawa Unit Trust (the Scheme) is invested in Mercer Investment Trusts New Zealand’s Socially Responsible Conservative, Balanced and Growth Portfolio’s. Each portfolio has a different level of risk and accordingly different return expectations.

NOTE: The returns you receive are dependent on the investment decisions of WRFL, the fund management decisions of the Fund Manager and the performance of the investments. The value of those investments may go up or down. Note that even the lowest category does not mean a risk-free investment.

Your member account

When your contributions are made, they join a pool of assets from other members invested in that same portfolio. To keep track of the value of each person’s share of the pool, the total value of the assets in the pool is divided into units of equal value. Units are then allocated to your account. The value of your savings rises or falls depending on changes in the price of the investment assets owned. Unit prices are used to help track changes in the value of your Whai Rawa account.

For more information on the investments of Whai Rawa see the Other Material Information document or view the Whai Rawa Statement of Investment Policy and Objectives document.

Returns paid to members

On a daily basis, the value of your investment will rise or fall based on the unit price. In our new member account platform, you’ll notice that the value of your Whai Rawa savings is being calculated and available daily. The number of units you own and their value will appear alongside your account balance when you check your account.