If you manage the Whai Rawa account for your tamariki or mokopuna, did you know that choosing the right fund can make a big difference to their future account balance?

We want to make sure you have all the information required to make the right decision on which Whai Rawa fund is best for them and potentially BOOST their account balance into the future! If you received something in the post from us please take the time to read and understand it. The right fund choice for them may have a substantial impact on the amount they can withdraw.

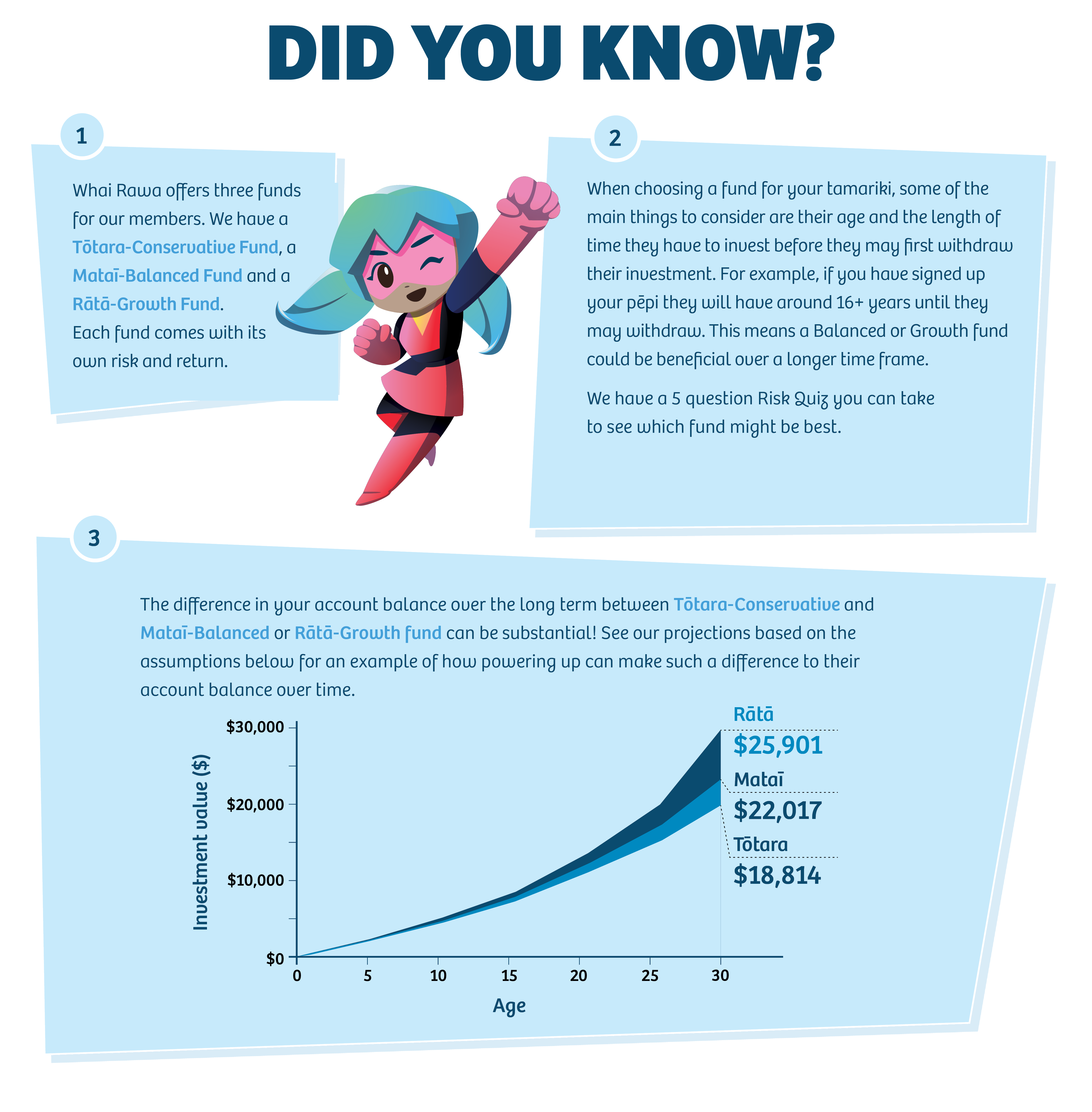

The above projections (based on the assumptions below) show how your tamariki or mokopuna could benefit from picking a fund that suits their timeframe and appetite to risk. The three funds all have different risk profiles. For more information head to Fund Options – Whai Rawa – Te Rūnanga o Ngāi Tahu

The above projections (based on the assumptions below) show how your tamariki or mokopuna could benefit from picking a fund that suits their timeframe and appetite to risk. The three funds all have different risk profiles. For more information head to Fund Options – Whai Rawa – Te Rūnanga o Ngāi Tahu

READY TO POWER UP?

To see and change what fund your tamariki are currently in:

- Take our 5 question Risk Quiz below to see which fund might suit them best. Remember when choosing a fund for your tamariki, some of the main things to consider are their age and the length of time they have to invest before they may first withdraw their investment. For example, if you have signed up your pēpi they will have around 16+ years until they may withdraw. This means a Balanced or Growth fund could be beneficial over a longer time frame. Our quick Risk Quiz may help you to make a decision.

- Log in to their Whai Rawa account on the link below. If you haven’t logged into their account before you’ll need to use their Whakapapa or Whai Rawa number to access it. Follow the instructions on the page or give us a call if you need help. Call us – 0800 WHAI RAWA Email us – [email protected]

Assumptions: The above graph assumes starting your Whai Rawa account at age 0 and contributing $50 a year from 0-15 years, then from age 16, contributing $200 a year to qualify for the full Matched Savings Contribution of $200 each year from Te Rūnanga o Ngāi Tahu. It also includes an Annual Distribution of $125 from Te Rūnanga each year. The Matched Savings Contribution and Annual Distribution are at the annual discretion of Te Rūnanga but have been included based on existing criteria and amounts. Contributions Te Rūnanga makes to your Whai Rawa account are taxed under the Retirement Scheme Contributions Tax (RSCT) rules, and you can find more information here: www.whairawa.com/tax-information. The RSCT rate applied to the Te Rūnanga Contributions in the graph is 10.5%

up until age 21, increasing to 30% thereafter on the assumption that the member’s RSCT will increase over time, noting Te Rūnanga generally attach 10.5% Māori Authority Credits to distributions which economically offsets part or all of the RSCT liability.

The investment return assumed is that as prescribed by the Government for KiwiSaver annual member statements for funds of the same

risk category, sourced from the Financial Markets Conduct Regulations 2014 legislation, set independently by the Government

www.legislation.govt.nz/regulation/public/2014/0326/latest/LMS210887.html. All amounts are after fees and taxes.

This information does not take into account your personal objectives, financial situation or needs. It is intended for information purposes only and should not be regarded as financial advice. Inflation has not been taken into consideration. Historical market performance may not be indicative of future market performance. You should not act on this information if you have not considered the appropriateness of this information to your personal objectives, financial situation and needs. Before making any investment decision, you should refer to the Product Disclosure Statement and / or consult a licensed financial advice provider.

Whai Rawa Fund Limited is the issuer of the Whai Rawa Unit Trust. A copy of Whai Rawa’s Product Disclosure Statement is available at

www.whairawa.com/pds. Whai Rawa Fund Limited’s financial advice disclosure statement is available here www.whairawa.com/financial-advice.